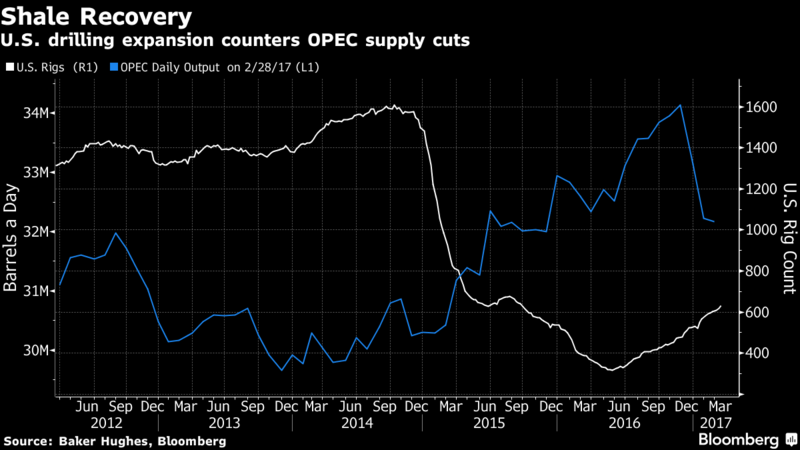

Oil Drops as U.S. Drilling Growth Threatens to Counter OPEC Cuts

Pub Date:Mar 21, 2017 | Views:191 |

Oil fell as a Libyan port is set to resume shipments and the U.S. drilling revival undermines the potential for OPEC output curbs to rebalance the market.

Futures dropped 1.2 percent in New York. Saudi Arabian Energy Minister Khalid Al-Falih said on March 16 that the kingdom may extend its cuts if supplies stay above the five-year average. A day later, though, data showed the U.S. rig count growing for a ninth week, and a Libya official said Sunday that the Es Sider and Ras Lanuf ports are preparing to restart oil exports.

U.S. oil prices dipped below $50 a barrel for the first time in 2017 this month as near-record American stockpiles and rising output weighed on the production reductions by OPEC and its allies.

While the Organization of Petroleum Exporting Countries won’t decide until May whether to prolong the cuts, ministers including Russia’s Alexander Novak will meet this weekend in Kuwait to discuss the deal’s progress. Money managers cut net-long positions on oil by a record.

"The reopening of the Libyan ports is the reason for today’s drop and the U.S. rig count doesn’t help," Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York, said by telephone. "The drop in net-length is a signal from speculators that the market is vulnerable."

West Texas Intermediate for April delivery, which expires Tuesday, fell 56 cents to settle at $48.22 a barrel on the New York Mercantile Exchange. The more-actively traded May contract dropped 40 cents to $48.91. Total volume traded was about 4 percent below the 100-day average.